After COVID-19 and following the sharp inflation rate rise, many were expecting house prices to crash.

The reality is that house prices did indeed dip, but not by a huge amount. According to Nationwide, prices have dropped just 2% in 2023.

What’s more, other reports have suggested that although there is an overall drop for the year, prices are actually on the up since the Autumn.

So why haven’t prices dropped significantly? The team at Benwell Daykin list some of their thoughts.

Interest rates have remained stable

When the Bank of England began to raise interest rates, many took a step back from looking to move due to affordability. If interest rates rise then mortgage costs do too. This meant that many home owners had to reduce their prices to continue to entice buyers.

Now however, interest rates have remained at a steady 5.25 per cent since August 2023.

House prices have already dipped to reflect this change and have remained stable along with the rate of interest.

Unemployment remains steady

When the population struggles to find work then this, of course, has a knock on effect on the economy.

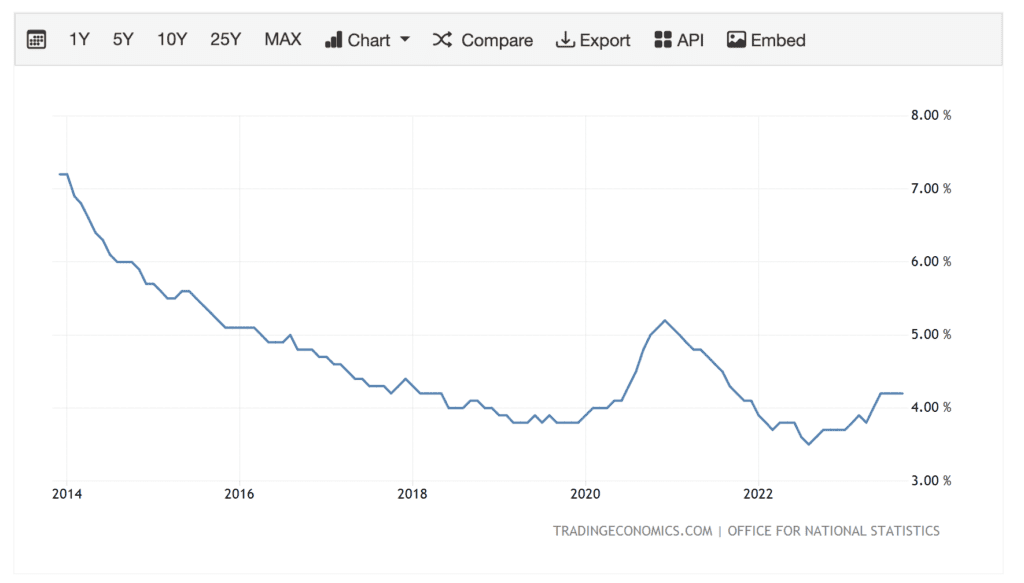

Unemployment has risen in 2023, however it is much lower than both 2014 and 2021 according to Trading Economics.

Mortgage rates are coming down

When interest rates began to rise, so did mortgage rates. Some home owner’s monthly payments began to triple.

Some others had made offers on higher priced houses but suddenly couldn’t afford them when rates went up.

As such, home owners again lowered prices to combat this.

Now mortgage rates are dropping once again. Although they are certainly nowhere near where they were a couple of years ago, some lenders now have products at below 5 per cent.

If rates fall further, this could actually boost house prices.

This puts confidence back in the property market and heightens affordability once again.

Inflation has slowed

Inflation cooled more than expected in October 2023, from 6.7 per cent to 4.6 per cent.

It has now more than halved from its peak of 11.1 per cent in October 2022. This has been a relief for many who are struggling with the cost of living.

Inflation slowing is another confidence boost to the property market.

So will we see a market crash?

Unfortunately, we don’t have a crystal ball here at Benwell Daykin.

All the above seems very positive and if things continue as they have been doing, we would expect to see house prices increase rather than decrease.

However, the world and the economy is ever changing and we just don’t know what tomorrow might bring.

How much is your house worth right now? Where ever you are in Nottinghamshire, contact our friendly team to find out today.